Our regular landlord surveys provide us with valuable insights into the landlord's experience of renting out properties, giving them an opportunity to share their views of how the market is changing, their future intentions and the drivers behind those intentions. Over 1,200 landlords responded to our latest survey to share their insights.

Property portfolios

The landlords responding to the survey reflect a range of different backgrounds, from those with large portfolios working full time as landlords, to those with a single property that was perhaps never intended to be a rental.

Of the 1,258 who replied:

61%

purchased all their properties specifically for use as rentals. Another 30% either inherited their rental property or originally bought their rental as their main home.

57%

own one or two properties, with another 38% owning between three and ten properties.

57%

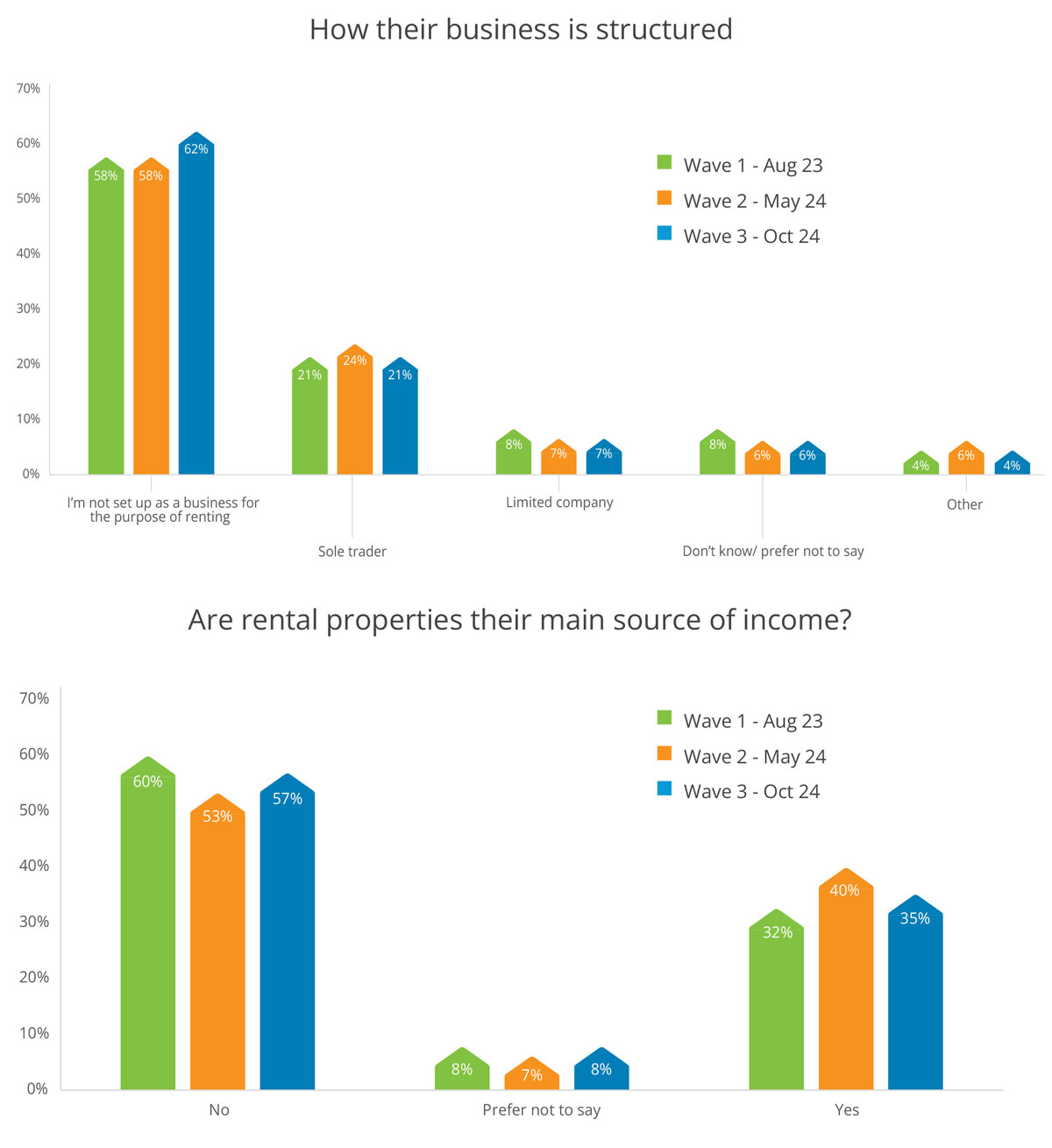

have another primary source of income (up 4% from May), with 35% stating rental income remains their main source of income.

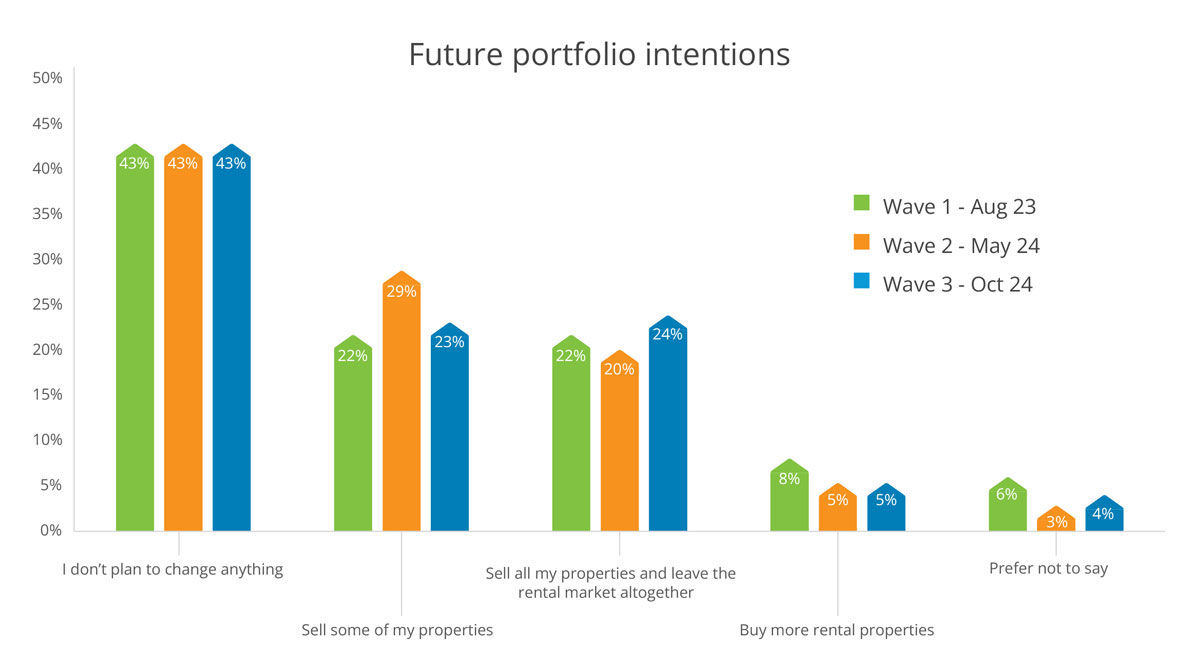

47%

are considering whether to sell some or all of their portfolio (down 2% from May), with 24% of these considering exiting the market fully in the next two years.

Legislation, tax and the landlord mindset

Changing legislation and the taxation landscape are the single greatest concerns among landlords, and for nearly 90% of those thinking of selling their properties, this is the key consideration.

Of the landlords who indicated they were considering selling some or all of their properties:

94% named Section 21 reform as a concern

91% were concerned about Capital Gains Tax changes

The Renters Rights Bill was front of mind for 91% of respondents

With the impact of legislation, rising maintenance costs and buy to let mortgage costs impacting the ability to make a profit, 76% of these landlords also cited returns from letting as a significant consideration.

Raising rents and advance payments

Whilst the number of landlords who raised rents in the past 12 months has slightly decreased, the number planning to put up rents in the next six months has increased. Since May, 45% told us they've increased rents compared to 48% in the previous survey, whilst 17% of landlords plan to increase rents within the next six months (up 2%), and a further 19% expecting to increase rents within 12 months (up 3%). Only 19% of landlords intend to leave rents unchanged.

The key drivers behind rent increases, named by around 75% of respondents, are legislation costs, maintenance costs and maintaining rental values in line with local markets.

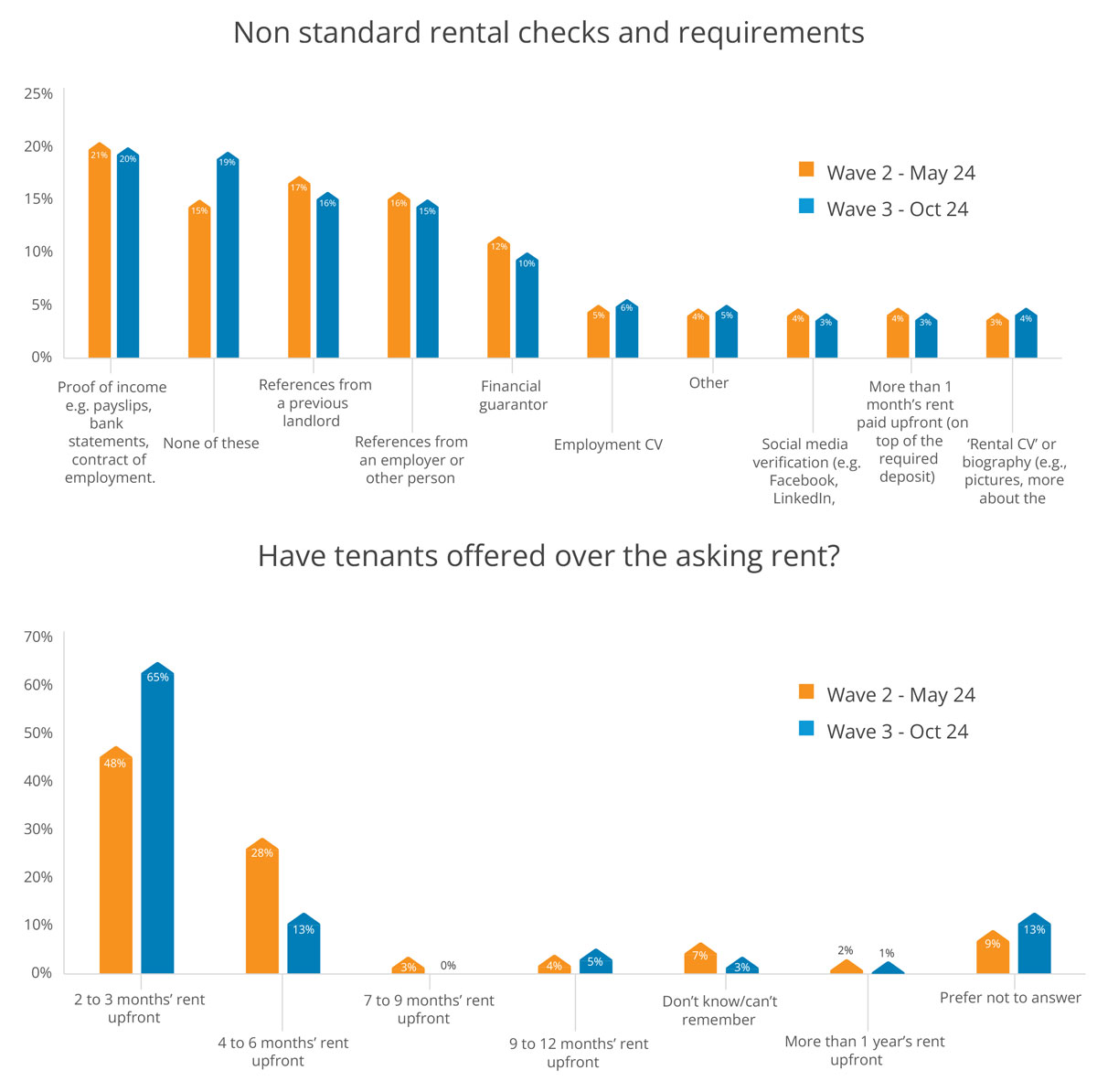

Along with fewer landlords raising rents in the last six months, we've also seen a shift in the amount of rent taken in advance. The number of landlords asking for between four and six months' rent upfront has fallen 15% since May to just 13% of respondents, but those asking for between two and three months' rent is up 17% to 65%.

Landlords have also told us the number of tenants putting in offers above the asking rent has fallen from 17% to 14%.

The changes in both the amount of rent being taken upfront, and the volume of tenants submitting “above asking rent” offers in to secure a tenancy perhaps indicates a cooling in demand for rental properties, although this is in conflict with the view that many landlords are considering exiting the market, or at very least divesting some of their rental portfolios.

Is demand for rental properties changing?

52% of landlords responding to our survey said they'd offered at least one property for rent. Of these:

35%

said there was no change in the number of people applying to rent their property.

35%

said the number of people applying to rent their property has increased but hasn't doubled.

17%

said the number of people applying to rent their property has roughly doubled.

13%

said the number of people applying to rent their property has more than doubled.