Are rising costs and the impact of legislation driving landlords to consider their future within the rental market?

Could the cost and effort of renting out property in today’s PRS be putting off those new to the industry?

These are some of the questions addressed in our analysis of the PRS market statistics, combining data from the Ministry for Housing, Communities and Local Government (MHCLG) and findings from our regular surveys of tenants and landlords who are active in the market.

The latest statistics from MHCLG pulls together information from all three deposit protection providers and shows the number of deposits protected across England and Wales currently stands at 4.67 million, with 54% of deposits held in Custodial schemes.*

*Source: MHCLG - TDP Six Monthly Report September 2024

Though the number of tenancies in England and Wales has continued to grow, the rate of that growth has slowed. In the last 12 months the number of deposits protected rose by just under 77,000. This is the first time the rental market has grown by less than 100,000 tenancies in any 12-month period in the last eight years, and less than a third of the 250,000 increase in deposits protected in 2017.

What could be driving the tenancy slowdown?

Just under a quarter of landlords who responded to our survey told us they were considering selling all their properties and leaving the PRS, citing the potential of an increased burden of legislation such as the Renters Rights Bill, which includes provisions for changes to no-fault eviction, Section 21 reforms, as key factors. In addition, concerns were voiced over changes in Capital Gains Tax, and the growing difficulty in generating a return from their property portfolios. It seems for some landlords, the effort required to operate may be starting to outweigh the benefits.

The cost of being a tenant

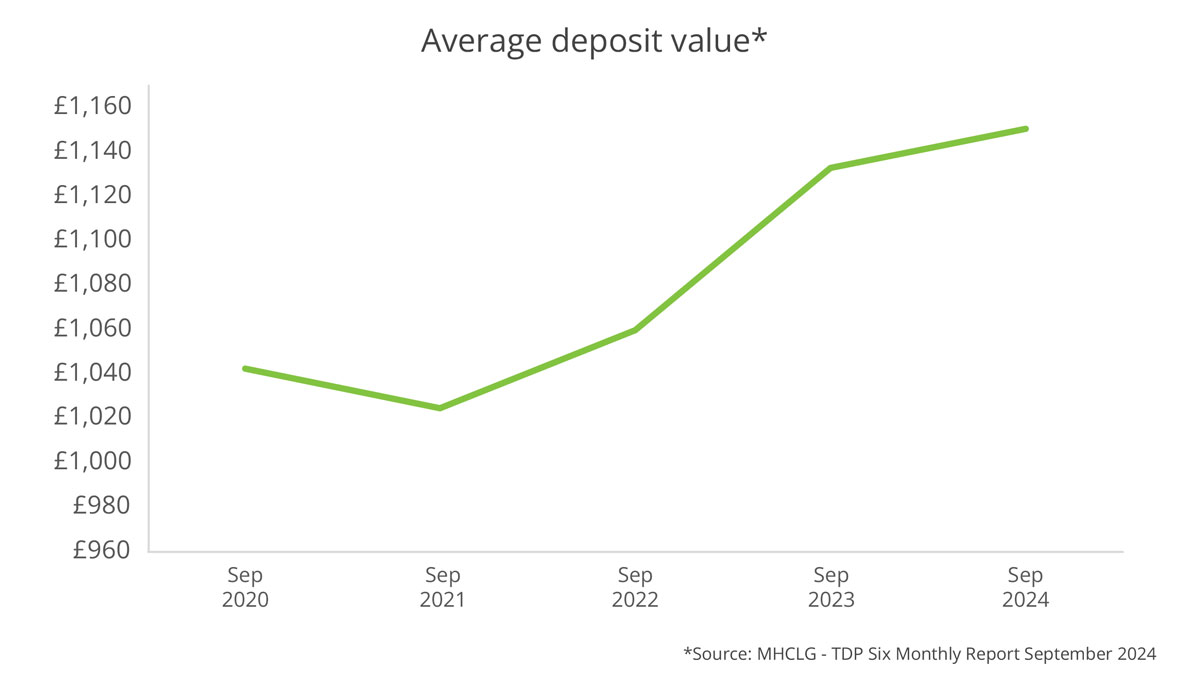

Affordable rent continues to remain a talking point for tenants, though there are some signs the impact is softening. Rents are likely to have risen in line with average deposit values, with our data indicating the factors driving increased rents include increasing costs to landlords due to changes in legislation, higher maintenance costs and maintaining rental values in line with local markets.

Rising rental costs appear to be a key reason behind tenants staying in their properties longer. Our tenancy data shows average tenancy lengths continue to grow, now standing at just over two years and six months (910 days), up 28 days from 2023 and over four months longer than in 2021.

Higher rents for new tenancies, increased moving costs, and difficulty finding suitable properties - driven perhaps by the year-on-year slowdown in the number of properties added to the market - are working together to drive tenants to extend the amount of time they’re staying in their rentals. We believe the result of a combination of these factors is a decrease in the number of tenants who have moved in the last six months.